GeneDx Holdings: Profits On The Horizon For AI Driven Health Platform (NASDAQ:WGS)

LeoWolfert/iStock via Getty Images

GeneDx Holdings (NASDAQ:WGS) looks positive for the future as an investment as the company is on the verge of profitability. WGS is on track to turn a profit in 2025 according to analysts’ consensus estimates and the company. The company’s genomics-related diagnostic testing solutions are driving strong double-digit revenue growth. Margins are widening which has GeneDx on track to turn a profit next year. WGS’s growth and future profitability has a good chance to drive the stock higher over the long-term.

GeneDx Holdings Background

Through its genomics diagnostic testing solutions, GeneDx offers Centrellis, an artificial intelligence [AI]-driven health platform that combines digital tools with AI to process data for comprehensive health insights. This solution provides genetic diagnostic tests, health screens, and information. The focus of Centrellis is on pediatrics and rare diseases for children and adults. The solution is also used for hereditary cancer screening.

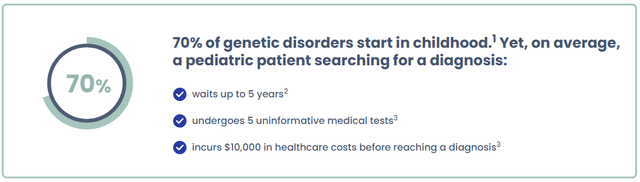

The focus on pediatrics is due to the fact that 70% of genetic disorders begin in childhood. Centrellis is an important solution for this since the average pediatric patient waits 5 years before searching for a diagnosis. The average pediatric patient then undergoes 5 uninformative medical tests and spends $10,000 in health care costs before reaching a diagnosis.

Centrellis can provide an earlier diagnosis to reduce medical interventions, to get more timely treatment options, and to provide resources and support for parents and family members. GeneDx sequenced over 665,000 exomes & genomes and performed over 1 million genetic tests so far.

Conditions Addressed by GeneDx

GeneDx.com

Growth Catalysts for GeneDx

The biggest catalyst for GeneDx in my opinion is margin expansion leading to next year’s expectations for profitability. Some of the main drivers of margin expansion has been: increased volume, improved average reimbursement rates, favorable mix shift, and continued cost per test leverage.

WGS increased its gross margin from about 45% in 2023 to over 60% in Q1 and Q2 of 2024. Total operating expenses also decreased from 84% of total revenue in 2023 to an average of 79% for Q1 & Q2 2024. The decrease in total operating expenses was driven by a reduction in SG&A from 96% of total revenue in 2024 to 59% in Q2 2024. R&D was also reduced from 29% in 2023 down to 15.5% in Q2 2024.

WGS’s operating income margin went from over a negative 100% in Q2 2023 down to a negative 15% in Q2 2024. These margin improvements have GeneDx on the path to profitability in 2025.

Increased revenue is also one of the driving factors for GeneDx’s increasing margins. WGS increased revenue by 52% to $68.9 million in Q2 2024 over Q2 2023. The company increased its revenue guidance for the full year to be between $255 million to $265 million. This is significantly higher than GeneDx’s guidance at the end of Q1 for a range of $235 million to $245 million. The increased guidance shows that GeneDx is confident in its ability to grow the top line. That should help widen margins further to help the company achieve profitability.

The demand for GeneDx’s Centrellis solution is driving the company’s revenue growth. WGS is focused on pediatric patients whose families seek an accurate diagnosis of their conditions. The company has been working on getting policies in place throughout the United States that ensure there is increased access to exome and genome testing. Currently, 14 states cover rapid genome sequencing. So, there is plenty of room for additional growth in more states.

GeneDx also partnered with biopharmaceutical companies and launched an access program for epilepsy patients. This partnership opened up access to exome testing and helped eligible patients enroll in clinical trials and other therapeutic opportunities. These efforts should help patients and families while driving WGS’s revenue growth.

It’s noteworthy to mention that GeneDx had 9 consecutive quarters of cash burn reduction. WGS’s cash burn for Q2 2024 was reduced 89% year-over-year to $6.1 million. The cash burn should continue to be reduced as the company reaches profitability.

GeneDx is in a leadership position in the field as the company has 80% market share for exomes among ordering clinicians. This gives the company credibility which can help increase growth going forward.

Valuation

Since GeneDx is not yet profitable, I think the price/sales ratio is the best metric to use for the stock’s valuation. WGS is trading with a trailing price/sales ratio of 3.7x and a forward price/sales of 3.5x. This is slightly higher than the trailing price/sales of 2.9x for the Health Information Services industry. This shows that the stock is valued slightly above average, but not at frothy overvalued levels.

GeneDx should be given an above-average price/sales ratio since the company is growing revenue at a strong, double-digit annual pace. Current consensus estimates are calling for 30% revenue growth for 2024. This looks reasonable given the company’s effective growth strategy in obtaining coverage in more states along with increased volume. The consensus estimates for 2024 revenue of $263 million are in upper portion of GeneDx’s projected range of $255 million to $265 million.

Plus, the slightly above-average valuation is also justified since GeneDx is so close to turning and maintaining a profit. GeneDx’s valuation should allow for further stock growth as the company continues to grow the top and bottom lines.

GeneDx’s Technical Perspective

GeneDx (WGS) Daily Stock Chart w/ RSI & MACD (Tradingview.com)

The stock has been on a strong uptrend in 2024. The stock also had a healthy pullback recently as the price dropped from the mid $35 area to the mid $25 area. The stock recovered from that dip and appears to be trending back up. This is indicated by the purple RSI indicator in the middle of the chart rising above its yellow moving average and above the 50 level, showing positive momentum. The MACD indicator at the bottom of the chart confirms the positive change in trend as the blue MACD line crossed above the red signal line and the histogram turned back to green. I would expect the stock to continue higher as GeneDx gets closer to profitability.

The Risks for GeneDx

Increased competition could be a competitive threat for GeneDx. GeneDx competes with Baylor Genetics, Centogene (OTC:CNTGF), Rady Children’s Hospital, and Exact Sciences (EXAS). The company’s competitors could offer attractive exome and genome solutions which could take market share away from GeneDx. The competitors could also increase their focus on pediatric solutions. The good news is that GeneDx is in a good leadership position for its pediatric focus. However, it is possible that the market share dynamics could change in favor of GeneDx’s competitors.

GeneDx could also fail to gain ground in additional states for insurance coverage. This could slow down the company’s growth rate and have a likely negative effect on the stock.

The company could also take longer than expected to reach profitability due to unforeseen circumstances. This could lead to deteriorating fundamentals and a sell-off for the stock.

GeneDx’s Long-Term Outlook

Investors should watch for GeneDx to gain coverage in additional states for ongoing long-term growth. Strong revenue growth, margin expansion, and the milestone of reaching and maintaining profitability are likely positive drivers for the stock. The valuation is reasonable enough to allow the stock to continue increasing as revenue and margins increase.

link