Gene Therapy Market Share & Trends Report, 2025-2034

Gene Therapy Market Size

The global gene therapy market size was valued at USD 9 billion in 2024. The market is expected to grow from USD 10.4 billion in 2025 to USD 51.3 billion in 2034, at a CAGR of 19.4% during the forecast period, according to the latest report published by Global Market Insights Inc. The growth of the market can be attributed to factors such as the expansion of gene delivery technologies including gene vectors, increased funding for gene therapy research, the rising incidence of cancer and other target diseases for gene therapy, the growing availability of cell & gene therapy manufacturing services, and increasing number of product approvals and launches.

To get key market trends

Download Free PDF

Additionally, the growing prevalence of genetic and rare diseases is aiding market growth. Conditions such as spinal muscular atrophy (SMA), hemophilia, and other rare diseases have limited treatment options, making gene therapy an appealing alternative for both clinicians and patients. For example, the total number of patients with hemophilia worldwide is estimated to be around 836,000, with approximately 284,000 severe cases. In the majority of cases, a single gene therapy treatment can provide long-term or even curative benefits, making lifelong care and medication unnecessary. With greater awareness and improved diagnostic methods, more patients are being identified for gene therapy treatments and trials, which further boosts the potential market base.

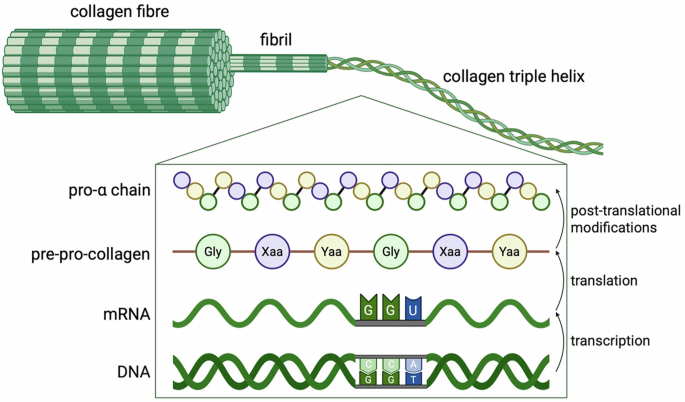

Gene therapy is a therapeutic technique that involves altering or modifying an individual’s genes to cure or prevent disease. It is employed to replace a faulty gene with a healthy copy of the same gene, inactivating a malfunctioning gene, or introducing a new or modified gene into the body to help treat a condition. Major gene therapy market players include companies such as Novartis, Spark Therapeutics (a Roche subsidiary), Bluebird Bio, BioMarin, and Pfizer. These companies drive the market with significant research and development investments, strategic partnerships, and commercialization of landmark therapies. Their success in gaining regulatory approvals and scaling up production volumes also influences pricing models and the pace of innovation across the industry.

Between 2021 and 2023, the market witnessed considerable growth, increasing from USD 6.5 billion in 2021 to USD 8 billion in 2023. A major trend during this period was the surge in clinical research and successful late-stage trials, which led to a wave of regulatory approvals for therapies targeting rare genetic disorders like spinal muscular atrophy and hemophilia. For instance, as per the NIH, as of March 2023, there were 3,900 clinical trials registered across 46 countries. This period also saw increased investments from pharmaceutical companies and venture capital firms, fueling innovation and accelerating product pipelines. Collectively, these developments strengthened investor confidence, increased the number of gene therapy candidates in development, and laid the groundwork for wider market adoption.

Gene therapy involves altering or manipulating a person’s genes to prevent or cure disease. It works by introducing, removing, or modifying genetic material within a patient’s cells to correct or compensate for defective genes responsible for a condition. This approach aims to address the root cause of genetic disorders rather than just managing symptoms.

Gene Therapy Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 9 Billion |

| Market Size in 2025 | USD 10.4 Billion |

| Forecast Period 2025 – 2034 CAGR | 19.4% |

| Market Size in 2034 | USD 51.3 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

| Opportunities: | Impact |

| Development of personalized and precision gene therapies | Tailoring treatments to individual genetic profiles will enhance efficacy and minimize side effects, resulting in higher adoption rates and treatment success. |

| Expansion in emerging markets with growing healthcare infrastructure | Expansion in countries with improving medical systems represents untapped demand for innovative therapies. |

| Market Leaders (2024) | |

| Market Leaders |

15.2% market share |

| Top Players |

Collective market share in 2024 is ~37% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Download Free PDF

Gene Therapy Market Trends

- A key trend shaping the market is the rapid approval and clinical success of several gene therapy candidates.

- For instance, as of March 2024, there are 36 gene therapies approved by the FDA, with an additional 500 in the pipeline and the expectation that 10–20 will be approved annually by 2025.

- Regulatory agencies worldwide are increasingly adopting expedited pathways, such as fast-track designations and priority reviews, to accelerate the availability of these groundbreaking treatments. This is driven by the urgent need to address rare and life-threatening genetic disorders with limited existing therapies.

- This growing number of successful clinical trial outcomes has also boosted confidence in the safety and efficacy of gene therapies, encouraging more investment and research in the field.

- Another key trend is the shift towards personalized medicine. Advances in genetic sequencing and bioinformatics are enabling the development of therapies tailored to the unique genetic makeup of individual patients. This customization improves treatment effectiveness and reduces adverse reactions, allowing therapies to be designed for very specific mutations or patient subgroups.

- Additionally, the expansion of gene therapy applications beyond rare inherited disorders into more common and complex diseases such as cancer, cardiovascular conditions, and neurological disorders is boosting market growth. Researchers and companies are increasingly focusing on harnessing gene editing and gene replacement technologies to target cancer cells or repair damaged tissues in chronic diseases. This broadening of therapeutic indications is expanding market potential and attracting greater interest from pharmaceutical companies and investors.

- Further, increasing investments by public and private organizations are accelerating innovation and commercialization in gene therapy. For example, between 2018 and 2019, public and private institutions in the U.S. and Europe invested more than USD 15 billion in cell and gene therapies, bolstering product development pipelines.

- Thus, as the pipeline of gene therapy candidates continues to grow across various therapeutic areas, the market is expected to continue expanding in the coming years.

Gene Therapy Market Analysis

Learn more about the key segments shaping this market

Download Free PDF

The global market was valued at USD 6.5 billion and USD 7.1 billion in 2021 and 2022, respectively. The market size reached USD 9 billion in 2024, growing from USD 8 billion in 2023.

Based on the vector, the global market is divided into viral vectors and non-viral vectors. The viral vectors include retroviral vectors, adeno-associated virus vectors, lentiviral vectors, and other viral vectors. The viral vectors segment accounted for 85.1% of the market in 2024.

- Viral vectors hold a significant market share in the market since they have proven highly efficient in the delivery of genetic material to target cells.

- Viral vectors, such as adeno-associated viruses (AAV) and lentiviruses, are preferred for their ability to produce stable and long-term gene expression, an important prerequisite for therapeutic efficacy.

- Additionally, the broad use of viral vectors is supported by established manufacturing processes and a positive track record in approved gene therapies like Zolgensma and Luxturna.

- While there is ongoing research on non-viral delivery methods, viral vectors remain the gold standard and continue to drive a large part of the market’s innovation and growth due to their reliability and efficacy.

- The non-viral vectors segment was valued at USD 1.3 billion in 2024 and is anticipated to grow at a CAGR of 21.7% over the forecast years. The segment includes plasmid DNA, lipid nanoparticles (LNPs), oligonucleotides, and other non-viral vectors.

- Non-viral vectors are generally considered safer compared to viral vectors. They do not carry the risk of viral replication or integration into the host genome, which can cause unintended effects. Non-viral vectors are less likely to trigger immune responses and are associated with lower toxicity, making them attractive for clinical use.

Based on the delivery method, the gene therapy market is segmented into in vivo gene therapy and ex vivo gene therapy. The in vivo gene therapy segment dominated the market in 2024 with a revenue of USD 5.8 billion.

- In vivo gene therapy enables systemic treatment, meaning it can reach multiple sites or organs throughout the body. This is particularly beneficial for diseases that affect multiple areas or have systemic manifestations, allowing for a comprehensive therapeutic approach.

- In addition, the development of advanced delivery systems such as viral vectors, nanoparticles, and lipid-based carriers, has improved the efficiency and specificity of in vivo gene therapy.

- These advancements enhance the targeted delivery of genetic material and improve the safety and efficacy of the therapy. This is expected to boost segmental growth in the market.

- The ex vivo delivery method is anticipated to witness growth at a CAGR of 18.5% over the analysis period, reaching USD 16.8 billion by 2034.

- The ex vivo delivery method is experiencing rapid growth within the market due to its ability to provide precise and controlled genetic modification outside the patient’s body before reintroducing the treated cells. This approach minimizes risks associated with direct in vivo delivery, such as immune reactions and off-target effects, making it especially effective for blood disorders and certain cancers.

- As a result, ex vivo methods are becoming a preferred strategy in the development of next-generation gene therapies, contributing substantially to overall market expansion.

Based on the gene type, the gene therapy market is segmented into antigen-encoding genes, cytokine-encoding genes, tumor suppressor genes, suicide genes, gene replacement (for deficiency), growth factor genes, receptor-encoding genes, and other gene types. The gene replacement (for deficiency) segment dominated the market in 2024 with a revenue of USD 1.9 billion.

- Gene replacement for genetic deficiencies has proven effective against various inherited diseases caused by missing or faulty genes. It involves introducing a normal copy of the defective gene to restore normal cell function, which is particularly valuable for monogenic diseases such as spinal muscular atrophy and hemophilia.

- The success of several approved gene replacement therapies has enhanced trust among investors and physicians, propelling further research and business in this area.

- On the other hand, the antigen-encoding genes segment is anticipated to witness growth at a CAGR of 21.5%.

- Antigen-based gene therapies can be employed as immunotherapeutic strategies. By introducing genes encoding specific antigens into a patient’s cells, the immune system can be activated or enhanced to recognize and attack tumor cells or pathogens. This approach has shown promise in cancer gene therapy and cancer immunotherapy, where antigens derived from cancer cells are targeted to elicit an immune response against tumors.

- Additionally, antigens can serve as specific targets for gene therapy interventions. By identifying antigens associated with particular diseases or conditions, gene therapies can be designed to specifically target and modulate the expression of these antigens, leading to more precise therapeutic effects. This is expected to support segmental growth in the market.

Based on the indications, the gene therapy market is segmented into oncology, neurological disorders, hemophilia A & B, hepatological diseases, inherited retinal disease, peripheral arterial disease, and other indications. The oncology segment dominated the market with a market share of 41.3% in 2024 and is anticipated to grow at a CAGR of 21.7% between 2025 – 2034. The oncology segment is further segmented into Acute Lymphoblastic Leukemia (ALL), large B-cell lymphoma, head & neck squamous cell carcinoma, and melanoma.

- Gene therapy allows targeted and precise delivery of therapeutic genes to cancer cells.

- By selectively modifying or killing cancer cells while sparing healthy cells, gene therapy minimizes off-target effects and reduces the toxicity associated with traditional treatments.

- Moreover, gene therapy has the potential to enhance the efficacy of traditional cancer treatments such as chemotherapy and radiation therapy.

- Further, the growing prevalence of cancer globally supports the rapid expansion of this segment. For instance, in 2025, approximately 2,041,910 new cancer cases and 618,120 cancer deaths are projected to occur in the U.S. alone.

- The neurological disorders segment held the second-largest market share in 2024, with a revenue of USD 2.3 billion.

- The increasing prevalence of neurological conditions, combined with successful clinical trials and approvals of therapies targeting these diseases, is driving significant investment and development in this segment.

- As research continues to deliver new gene-based treatments, the neurological disorders segment is anticipated to witness continuous growth over the forecast period.

Learn more about the key segments shaping this market

Download Free PDF

Based on the end use, gene therapy market is classified into hospitals, specialty clinics and gene therapy centers, academic and research institutions, and other end users. The hospital segment dominated the market in 2024 with a market share of 56.4%.

- The hospitals segment commands a significant share of the market, serving as the primary setting for the administration and delivery of these advanced treatments.

- Hospitals offer specialized infrastructure, skilled healthcare professionals, and the supportive care required to manage the complex procedures and monitoring associated with gene therapies.

- Many hospitals are increasingly collaborating with biotech firms and participating in clinical trials, further strengthening their position in the gene therapy ecosystem.

Looking for region specific data?

Download Free PDF

North America Gene Therapy Market

The North America market dominated the global market with a market share of 51.2% in 2024.

- A favorable regulatory environment, strong financial and investment support, advanced healthcare infrastructure, and robust research and development ecosystem are key factors driving regional market growth.

- North America, particularly the U.S., has a well-established research and development ecosystem in the field of gene therapy. It is home to leading academic institutions, research centers, and biotechnology companies that actively contribute to advancements in gene therapy research. This ecosystem fosters innovation, attracts investment, and drives the development of novel gene therapies.

- Furthermore, the high prevalence of genetic disorders and complex diseases, such as cancer, in North America has created substantial demand for innovative treatment options like gene therapy.

- Additionally, the willingness of payers to support these therapies through reimbursement programs further fuels market growth.

The U.S. gene therapy market was valued at USD 3.1 billion and USD 3.4 billion in 2021 and 2022, respectively. The market size reached USD 4.2 billion in 2024, growing from USD 3.8 billion in 2023.

- The U.S. continues to dominate the market, driven by its robust biotechnology ecosystem, substantial research funding, and a favorable regulatory environment.

- The country hosts several leading pharmaceutical and biotechnology companies and benefits from a strong pipeline of innovative gene therapy candidates and cutting-edge technologies.

- Additionally, the presence of top-tier research institutions and extensive clinical trial activities further accelerates the development and commercialization of new therapies.

Europe Gene Therapy Market

Europe market accounted for USD 2.3 billion in 2024 and is anticipated to show lucrative growth over the forecast period.

- Europe holds a significant share of the global market, supported by its advanced healthcare infrastructure, increasing government initiatives, and rising investments in biotechnology development.

- The region benefits from a highly collaborative ecosystem involving academic institutions, research organizations, and pharmaceutical companies, which accelerates the development and adoption of gene therapies.

Germany dominates the Europe gene therapy market, showcasing strong growth potential.

- Within Europe, Germany holds a substantial share of the market, supported by its advanced medical research infrastructure, strong industrial base, and favorable government initiatives.

- The country’s emphasis on precision medicine and biotechnology has created a dynamic environment for the development and commercialization of gene therapies.

- Moreover, Germany’s robust healthcare system and high patient access rates further facilitate the adoption of these innovative treatments.

Asia Pacific Gene Therapy Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 22.8% during the analysis timeframe.

- The Asia Pacific region is experiencing rapid growth in the global market, driven by increasing healthcare investments, a rising incidence of genetic disorders, and greater access to advanced medical technologies.

- Governments across the region are strengthening biotech infrastructure and supporting clinical research through funding initiatives and international collaborations.

- Furthermore, the region’s large patient population, growing awareness of genetic diseases, and expanding presence of local biotechnology companies are fueling demand for innovative gene therapy solutions.

China gene therapy market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- China dominates the Asia Pacific market, driven by substantial biotech R&D investment, supportive government policies, and a rapidly expanding clinical trial landscape.

- The Chinese government has prioritized genomics and advanced therapies within its national health and innovation agenda, providing significant funding and implementing regulatory reforms to foster growth.

- With strong manufacturing capabilities, expanding healthcare infrastructure, and rising domestic demand, China is at the forefront of gene therapy innovation in the Asia Pacific region.

Latin American Gene Therapy Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil is emerging as a key growth center in the Latin America market, driven by an expanding healthcare sector, increasing investment in biotechnology, and a rising prevalence of genetic disorders.

- The country’s large population and improving access to advanced medical treatments are generating strong demand for innovative therapies.

- Additionally, supportive regulatory reforms and the establishment of public-private partnerships are encouraging clinical research and local development of gene therapies.

Middle East and Africa Gene Therapy Market

South Africa market to experience substantial growth in the Middle East and Africa market in 2024.

- South Africa is demonstrating significant growth potential in the Middle East and Africa market, driven by rapidly developing medical infrastructure and a rising focus on genetic research.

- The country is home to several prominent research institutions and shows growing interest in addressing inherited and chronic diseases through innovative treatments.

- Increased collaboration with global biotechnology firms, along with government initiatives to strengthen healthcare delivery, is expected to further drive market growth.

Gene Therapy Market Share

The competitive landscape of the market is characterized by intense innovation and collaboration among established pharmaceutical giants, emerging biotech startups, and academic institutions. Top players such as Novartis, bluebird bio, Spark Therapeutics, Vertex Pharmaceuticals, and Pfizer hold a combined market share of ~37% in the global market. These players are continuously investing in research and development to expand their pipelines and enhance delivery technologies. The market also sees strategic partnerships, mergers, and acquisitions aimed at accelerating the commercialization of novel therapies and accessing new markets.

Additionally, smaller players and niche biotech firms contribute by focusing on specialized therapies and cutting-edge technologies like CRISPR and non-viral vectors. This dynamic environment fosters rapid technological advancements and competitive differentiation, driving the overall growth and diversification of the market.

Gene Therapy Market Companies

Prominent players operating in the market are as mentioned below:

- Amgen

- Applied Genetic Technologies Corporation (AGTC)

- Audentes Therapeutics, Inc. (Astellas Pharma)

- Bayer

- Beam Therapeutics

- BioMarin Pharmaceutical

- bluebird bio

- Bristol-Myers Squibb Company

- CRISPR Therapeutics

- Gilead Sciences

- Helixmith

- Intellia Therapeutics

- Krystal Biotech

- Novartis

- Orchard Therapeutics

- Pfizer

- Sangamo Therapeutics

- Sarepta Therapeutics

- Spark Therapeutics (Roche)

- UniQure N.V.

- Novartis

Novartis is a key player in the market with a leading market share of ~15.2. The company is primarily known for its groundbreaking treatment Zolgensma, used to combat spinal muscular atrophy (SMA). The company’s strong focus on rare genetic disorders and its robust manufacturing capabilities have positioned it at the forefront of gene therapy innovation and commercialization.

Acquired by Roche, Spark Therapeutics is a pioneer in gene therapy, best known for Luxturna, the first FDA-approved gene therapy for inherited retinal diseases. The company combines cutting-edge research with Roche’s global reach, accelerating the development and accessibility of novel gene-based treatments.

- Vertex Pharmaceuticals

Vertex Pharmaceuticals is a key player in the market, focusing on innovative treatments for genetic blood disorders such as sickle cell disease and beta-thalassemia. Their work with CRISPR-based gene editing technology exemplifies their commitment to precision medicine. With a strong pipeline and strategic partnerships, Vertex is advancing cutting-edge therapies that have the potential to transform patient outcomes into inherited diseases.

Gene Therapy Industry News

- In January 2024, Biogen and Ginkgo Bioworks announced the completion of their gene therapy collaboration involving AAV based vectors. This is expected to fuel the demand for gene therapies in the coming years.

- In December 2023, the Swiss Agency for Therapeutic Products granted approval to Libmeldy for the treatment of early-onset metachromatic leukodystrophy.

- In June 2023, the U.S. FDA granted approval to Sarepta for ELEVIDYS gene therapy to treat DMD in children of age 4-5 years.

- In May 2023, the FDA approved Vyjuvek, a herpes-simplex virus type 1 (HSV-1) vector-based gene therapy, for the treatment of wounds in patients 6 months and older with dystrophic epidermolysis bullosa (DEB) and mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene.

- In April 2023, REGENXBIO Inc. announced that the FDA has given fast track designation to RGX-202, a possible one-time gene therapy for the treatment of Duchenne muscular dystrophy (Duchenne).

- In December 2022 Kite Pharma, Inc. and Daiichi Sankyo Co., Ltd. announced that the Japan Ministry of Health, Labour and Welfare (MHLW) has approved Yescarta (axicabtagene ciloleucel), a chimeric antigen receptor (CAR) T-cell therapy, for the initial treatment of patients with relapsed/refractory large B-cell lymphoma (R/R LBCL) diffuse large B-cell lymphoma, primary mediastinal large B-cell lymphoma, transformed follicular lymphoma, and high-grade B-cell lymphoma. Only patients who have not previously had a transfusion of CAR T cells directed against the CD19 antigen should be treated with Yescarta.

- In May 2021, Biogen Inc. and Capsigen Inc. entered into a strategic research collaboration to engineer novel adeno-associated virus (AAV) capsids that have the potential to deliver transformative gene therapies that address the underlying genetic causes of various CNS and neuromuscular disorders.

The gene therapy market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 – 2034 for the following segments:

Market, By Vector

- Viral vectors

- Retro viral vectors

- Adeno-associated virus vectors

- Lentiviral vectors

- Other viral vectors

- Non-viral vectors

- Plasmid DNA

- Lipid nanoparticles (LNPs)

- Oligonucleotides

- Other non-viral vectors

Market, By Delivery Method

- In vivo gene therapy

- Ex vivo gene therapy

Market, By Gene Type

- Antigen-encoding genes

- Cytokine-encoding genes

- Tumor suppressor genes

- Suicide genes

- Gene replacement (for deficiency)

- Growth factor genes

- Receptor-encoding genes

- Other gene types

Market, By Indication

- Oncology

- Acute lymphoblastic leukemia (ALL)

- Large B-cell lymphoma

- Head & neck squamous cell carcinoma

- Melanoma

- Neurological disorders

- Duchenne muscular dystrophy (DMD)

- Spinal muscular atrophy (SMA)

- Hemophilia A & B

- Hepatological diseases

- Inherited retinal disease

- Peripheral arterial disease

- Other indications

Market, By End Use

- Hospitals

- Specialty clinics and gene therapy centers

- Academic and research institutions

- Other end users

The above information is provided for the following regions and countries:

- North America

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

link